A few years ago I wrote an article about the loan sharks at Western Sky Financial and how they take advantage of unsuspecting consumers with their high interest payday loans. Since writing that piece, it became the second most visited and the top commented page on my site. It also generates a few emails a week from people who stumble upon it and thank me for giving them a “heads up” before they get sucked into one of these loans.

As I was going through my email today, I received this message from a visitor, “Is Western Sky still loaning money out? I’ve been trying to call the 800 number and nobody picks up.”

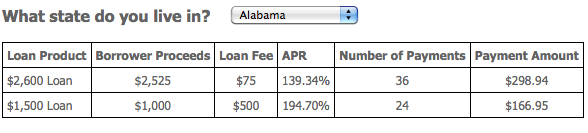

Knowing that predator lenders never sleep, I found it pretty hard to believe they wouldn’t answer the phone. After all, there’s plenty of money to me made off of people willing to pay upwards of 200% interest on a loan.

When I visited their website, I was happy to see a note on their homepage letting visitors know that they have ceased operations as of September 3, 2013.

Western Sky Financial Suspends Operations

Company Forced to Lay Off Nearly 100 Workers Due to Unwarranted Regulator OverreachSeptember 3, 2013 – EAGLE BUTTE, SD – Western Sky Financial officially will be suspending its operations today as a result of unwarranted overreach by state regulators. As a result, 94 people in the impoverished Eagle Butte community have lost their jobs, undermining the economic security of their families and this entire community.

“Regulators from the State of New York and other states lack the authority to regulate legal commerce engaged by members of the Cheyenne River Sioux Tribe on the Cheyenne River Indian Reservation,” said Steve Emery, founder of the Emery Law Firm in Eagle Butte and a spokesman for Western Sky Financial. “The consequence of this groundless overreach is the loss of 94 quality jobs in this economically disadvantaged community.”

The immediate cause of Western Sky’s suspension of operations was the effort by state regulators to pressure and intimidate banks, other financial institutions and payment processing services into choking off business with online lenders like Western Sky. Many of these lenders are based on Indian reservations and therefore subject to tribal, not state, laws and regulations.

“I’m deeply saddened that so many members of the Cheyenne River Sioux tribe have had their lives turned upside down because of regulators and bureaucrats thousands of miles away,” said Butch Webb, founder of Western Sky Financial. “Creating jobs here on the Cheyenne River Indian Reservation has been my proudest accomplishment, and its painful to know that my former employees face the prospect of long-term unemployment given the few job opportunities available to them.”

Western Sky Financial will maintain a limited staff to support the company’s efforts as it seeks to resolve the issues it faces in court.

Their announcement blames “unwarranted overreach on behalf of state regulators” for their demise, specifically the state of New York which recently filed suit against Western Sky. In the suit, Eric Schneiderman, the state’s attorney general, accuses Western Sky of violating the state’s usury laws that put a 25% interest rate cap on loans. One doesn’t need to do a whole lot of research to determine that Western Sky’s interest rates are obscenely above the 25% threshold.

Besides being responsible for paying back a loan at a high interest rate, consumers also agree to be bound by tribal, not state laws – a point that Western Sky makes in their defense, but I have a major problem with. Most, if not all, Western Sky loan applicants probably have no idea they are agreeing to be bound by laws they are not familiar with. Not to mention, the tribal laws are written to protect the interest of the tribe, therefore I’m sure there’s nothing written in them about usury.

The statement issued by the tribe paints a dim picture for the 94 people who lost their jobs due to the shutdown. But one has to ask, “what about the thousands of people who were taken advantage of by Western Sky?”

What about them?